Are tips taxed? Everything you need to know about tips and taxes

Pete Zimmerman | 10/30/2022

This post at a glance

( TL ; DR )

If you're in a hurry, you can also hit GO TO VIDEO below

Read time: 8 minutes

Summary: Every time that you earn money, the law says that the IRS gets a cut. Your reward for complying is...drumroll...not going to jail. When you only earn regular wages or a salary at work, it's pretty simple - you complete a W-4 when you first start, and your employer's payroll handles it for you. But what if you don't just earn a salary? Are tips taxed? Yes, but there are some twists that you need to know about. Taxes are considered income and are taxable, just like wages. But unlike wages, there's also a little legwork on your part to make sure that the reporting and payment are done right.

Disclaimer

This article includes general information and shouldn't be considered tax advice. For guidance tailored to your personal situation, consult a CPA or qualified tax advisor.

When you're a working class person, taxes are part of life

The IRS says that the average American spends $230 and 12 hours on their tax filings every year. Just for fun, with 143.3 million taxpayers in the US, total tax preparation costs almost $32 billion dollars and takes about 1.7 billion hours. It's hard to comprehend numbers this big, but here goes. 1.7 billion hours is about 194,000 years. If you were to go back that far into the past, it's theoretically when the first humans made their debut on this planet. That's a lot of collective time and effort.

Unfortunately for you (and unlike your distant ancestors), taxes are part of your life, and they will be for as long as you earn money. For people who work for an hourly wage or salary, taxes tend to be an afterthought that only surfaces during filing time. But if you’re a waiter/waitress, Uber driver, bartender, hair stylist, or really any service-related employee who earns tips, you may question whether those tips are taxed like the rest of your wages. Can just keep that extra cash?

Are tips taxed?

Since tips are separate from the standard hourly wages on your paycheck (especially tips you get in cash), you might guess that money is yours, tax-free. Nope, not the case. Everyone’s second-least-favorite US agency—the IRS—isn’t going to make it that easy for you (the VA must be pretty horrific, by the way).

First, tip earnings must be reported to your employer. By law, this applies to tips totaling more than $20 per month, per employer. For most service workers, like food servers, bartenders, valets, or rideshare drivers, tips aren’t just incidental. They’re part of the job and you’ll almost always earn more than $20 in one shift, let alone over an entire month.

Even if your employer doesn’t deliberately collect or keep records of tips earned, it’s your responsibility to report every penny. In turn, employers use this reporting to determine what you owe in taxes, and then deduct the appropriate amount from your wages for the IRS.

Hint: In the US, taxes are set up as a pay-as-you-go system. This means you’re supposed to pay taxes on the money as you earn it. Keep this in mind because it helps you understand the flow of the money, the steps, and the reasoning behind the IRS’s labyrinth of rules.

How to report your tips

Everyone has to report their tips to their employer AND to the IRS. For your employer, reporting has to be monthly (at a minimum) and to the IRS, it’s once a year (at tax time).

The federal rules around taxation are standardized, but every employer handles their part differently. Some will require you to report your tips after each shift. If you’re lucky, they may provide an electronic option or app to make it easy to report your tips and pay the taxes owed.

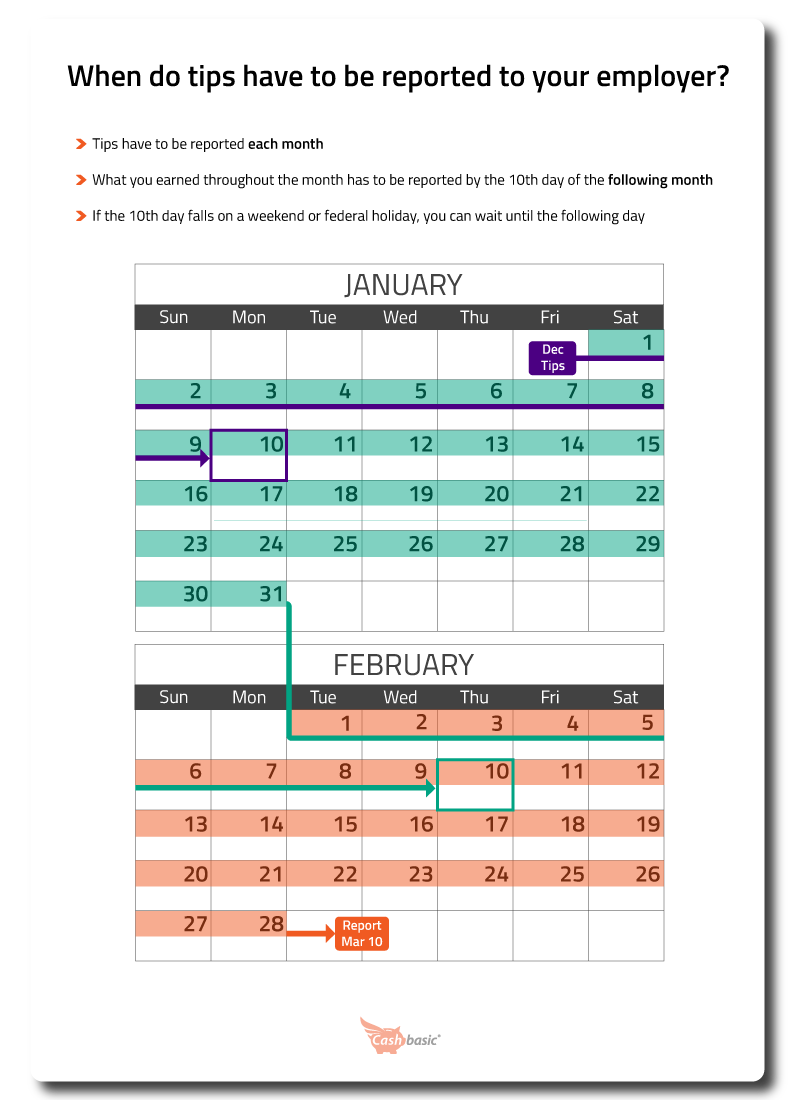

Others don’t have an electronic system and instead require you to report your tips at the end of each month using IRS Form 4070. If that’s the case, you must file this form by the 10th of the month following the month you earned the tips. So if you earned a $10 tip on a $123 bill from some cheapskate on January 20, you’d have to report it to your employer by February 10. If that day falls on a legal holiday or a weekend, you can wait until the next weekday.

Whichever method your employer uses, they’ll withhold (i.e. keep and send to the IRS on your behalf) the applicable taxes from tips earned from your next paycheck and report your earnings to the IRS. Think of it like this- your regular, hourly wages are being used as a pool to pay ALL of your tax liability, including what you owe due to tips. If you tend to earn a lot of cash tips, this will make your paycheck seem smaller, but it’s also taking care of your tax bill on that cash. In the end, it’s all a wash.

Why are tips taxed?

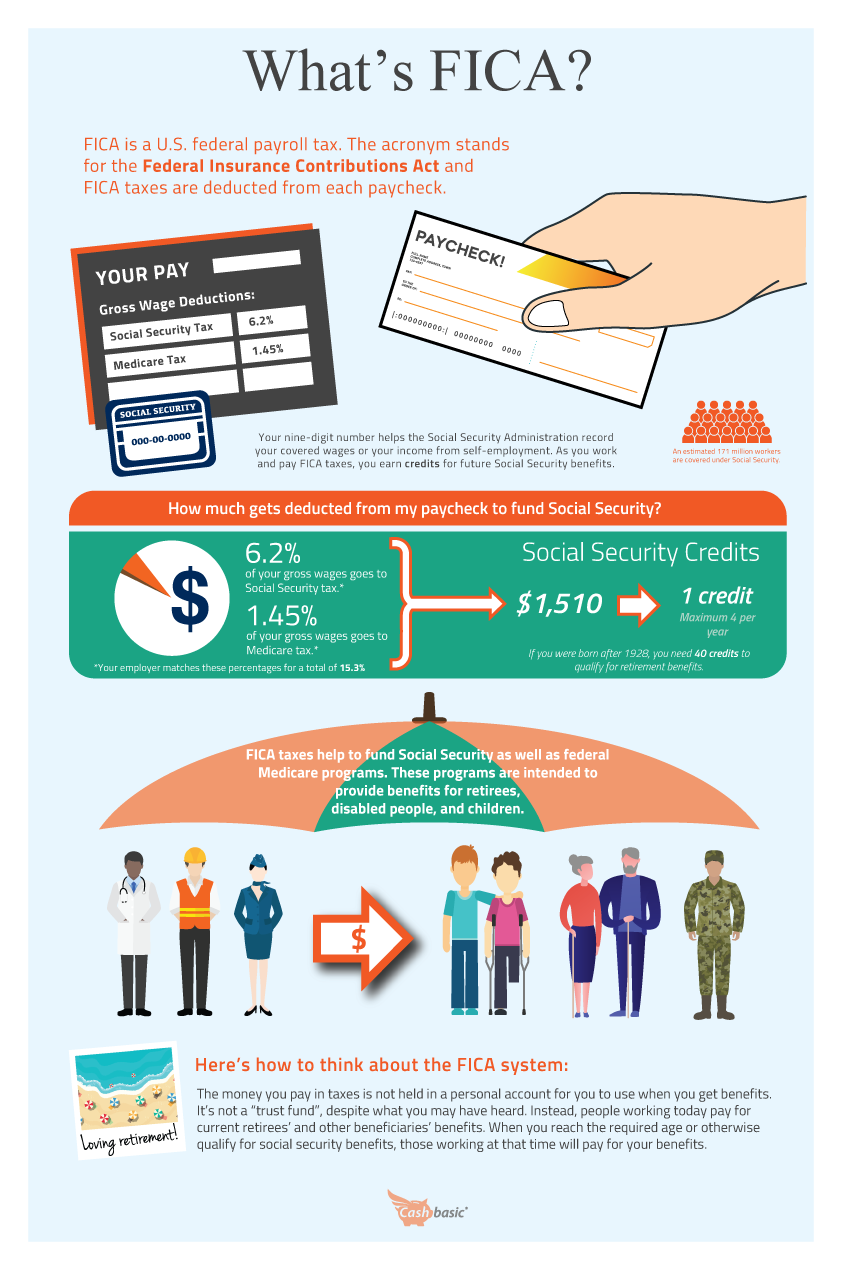

Tips are taxable income, just like your hourly wages. The floor for taxability on tips is $20 in a month, which is many multiples less than most service workers receive over a full month. Like standard wages, you must also pay your share of FICA (combined Social Security and Medicare) taxes on tip income. Since the 15.3% FICA rate has to be equally split between you and your employer, they pay the other half for you.

If you're self-employed, or a gig worker (independent contractor), you'll have to pay all of the FICA tax yourself, assuming you make over $400 per year. The good news is that you may be able to deduct some of that on your income taxes, but you'll need to talk to a CPA or tax professional to be 100% certain. Don't just wing that one.

Which tips are taxed?

In reality, all types of tips are taxed, but here are a few examples of taxable tips, just to drive home this point:

- Cash tips left on the table or handed to you for service you performed

- Tips left on a credit or debit card

- Tips paid to you from a shared pool of funds

Your employer will always know about tips paid on a credit card, and so does the IRS. There’s a paper trail so make sure you always claim 100% of your electronic tips. The upside is that this is simple for you – most of it happens automatically. Cash tips aren’t as traceable since there’s no electronic record, but you should still always report what you earn.

What about tip pooling and auto-gratuity?

You know what tip pooling is, right? If it doesn’t sound familiar, it’s the same thing as tip splitting and similar to tip sharing (when you tip out to coworkers). With tip sharing, the front-line employee—like a waiter, waitress, bartender, etc.—gets a tip and then voluntarily gives a cut to other workers in the chain of service, like bussers, runners, barbacks, hostesses, and others. The employer doesn’t usually enforce this, even if they set recommended tip share rates.

Pooling is more formal, and it’s subject to a number of laws and regulations that can vary by state. Pooling is an arrangement when all employees put their tips into a combined “pool”, which is then divided among everyone based on some pre-set rules. The bottom line is that what you earn isn’t what you get.

In both cases, you are only responsible for claiming what you actually take home. For example, if you earn a $100 tip, but tip out the busser and runner $10, you only need to report $90. No need to pay their taxes for them, on top of your own.

If your employer includes automatic charges or automatic gratuity for certain size parties, you generally aren’t required to include that in your reporting since it should already be included in your wages. Usually, any amount over the minimum is reportable. Your employer should be able to specify a policy on this. If you're self-employed, it's not going to apply to begin with.

Are tips taxed differently?

Are tips taxed differently than typical wages? That depends on how you’re paid.

If you earn tips at a regular W-2 job, such as a server at a restaurant, your tips are taxed just like your wages. You’ll pay your portion of the taxes as an employee and your employer will pay their share.

But, if you earn tips as a gig worker, such as driving for Uber or Lyft or delivering for DoorDash or Instacart, you’re considered an independent contractor. Or if you work out of your own studio as a hair stylist for example, you’re considered self-employed. Either way, there isn’t an "employer" to cover the other half of the taxes.

This means that unless you earn less than $400 a year (or you’ve got a clever tax structure set up), you pay the full amount of taxes (employer + employee) on your regular wages AND tips. You may also want to talk with a CPA about whether you need to pay taxes each quarter, since an employer won’t be paying them for you on a routine basis. Hint: you probably do.

Keeping track of your tips

You can see why keeping track of your tips is important. If you work for a large company, like a chain or corporate restaurant, they will likely have a system that requires you to enter your tips each day you work, as you earn them.

This is ideal.

If you’re on your own to report your tips, keep careful records on your phone, on a spreadsheet, or even in a notebook. And if your employer requires it (or if you just prefer bloated government forms), the IRS also offers Form 4070A to help you keep track of your tips.

Either way, you must keep track of your tips and report them to your employer. If you don’t report them in a timely manner, it can be considered tax evasion (not good, Al Capone) and you could be hit with a penalty for underpayment. Taxes are bad enough, but a penalty on top of it? That’s hard to stomach – don’t let it happen to you.

Reporting tips on your tax return

As stated earlier, at tax time, you must report your tips again. This time it’s to the IRS, and it’s your responsibility (not your employer’s), just like you report your regular wages. If you’re employed by a company or you already paid taxes on the earnings, you shouldn’t owe much if anything, but you’ll still need to report it.

Like any other employee earning W2 income, you might get a refund if you paid more than you actually owed, but there’s also the chance you could owe more if you didn’t pay enough throughout the year. If you underpaid, you could owe an underpayment penalty, so again, be sure to always report your tips on time to minimize the chances. Remember, even if you earned less than $20 in a month, you should report them at tax time.

You’ll also need to keep records of the date (and fair market value) of non-monetary tips that you get. This includes things like tickets, gifts, and other items that have cash value. These don’t have to be reported to your employer, but they need to be on your return.

| Employee / Self-employed | Report to employer | Report to IRS | Payment to IRS | Taxes owed |

|---|---|---|---|---|

| Employee | 10th of each month | Yearly on tax return | Income tax, 1/2 of FICA | |

| Contractor (i.e. gig worker) over $400/year | Yearly on tax return | Once per quarter | Income tax, full FICA | |

| Self-employed over $400/year | Yearly on tax return | Once per quarter | Income tax, full FICA |

IRS Form 4137 – unreported tips

If you accidentally overlooked earned tips or your employer didn’t report the tips you reported, you may be responsible for filing Form 4137. This form for unreported tips lets you come clean to the IRS about tips that should have been reported but weren’t.

Here’s the kicker, though.

Unless you have a good reason for overlooking the need to report the tips, you could be hit with a hefty penalty for late payment. There isn’t a flat dollar amount or set percentage for this penalty. It’s based on the total amount of underpayment, when it happened, and an interest rate set in an IRS table.

No matter what that number calcs out to, it means less money in your bank account and more to the IRS. But if you can provide a good reason and proof that you didn’t purposely ignore the need to report, you may have a chance at an exception. Your dog eating your tax forms isn’t going to cut it. But an unforeseen event like a casualty or a disaster, or becoming disabled are examples of valid reasons that the IRS might accept.

Final thoughts

If you wondered whether tips are taxed, you’ve got the answer now – it’s clearly "yes." You pay taxes on tips just like any other income. The key is to report tips as you earn them, so you can get the taxes out of the way, right away (just like your regular wages).

When you pay taxes as you go, as the system is designed, it helps you avoid a big hit at tax time. It can also help you qualify for credit in the future, like a car loan or mortgage, since lenders always look for proof of income. And it helps you avoid an audit, since the IRS uses clever systems and industry averages to help detect people who may be underclaiming tips. They may be evil, but they aren't stupid.

In reality, though, do you really have a choice? No, if you don’t report your tips on time, you’ll still have to eventually pay up, and you could owe an underpayment penalty on top of it. That leaves you with even less money in your pocket. Work with your employer or CPA to ensure your tips are taxed correctly to avoid any extra fees and hassle.

Video coming soon...

Share this post

There are no comments yet.

Pete Zimmerman

I've worked in financial services for more than a decade, and know where all the bodies are buried (and where the motivations are). I'm a Certified Financial Planner® and a licensed real estate broker, and love using what I've learned to simplify financial concepts and bring them to life in the real world, for working-class people like you.

Interested in more money ideas and solutions for your life?

Join Cashbasic's mailing list today and get exclusive content and offers direct to your inbox.

Social Connections

Special Thanks

Get Cashbasic's very best content (and exclusive offers) direct to your inbox.

No spam, ever. And we never share or sell your information.