The 3 things that actually MATTER when it comes to your money (for financial beginners)

Pete Zimmerman | 11/18/2022

This post at a glance

( TL ; DR )

If you're in a hurry, you can also hit GO TO VIDEO below

Read time: 5 minutes

Summary: Helpful advice doesn't have to be complicated. In fact, usually the best advice is also the simplist. But with personal finance, ulterior motives and lack of education have combined to twist the topic into a confusing fog of complex ideas and formulas. It's time to get back to the basics. These are the 3 foundational concepts that truly matter if you want to be successful with your money, and they matter to everyone.

You should be suspicious of anything that looks too complex. You should be extra suspicious of people who try to make simple things seem complex.

Want to know a secret?

You're being ripped off.

If you've ever thought that your credit card fees kill you compared to what you earn on the money you keep at the bank ... you're 100% right. And if you put in a little detective work (or just keep reading) you'll uncover a reality much worse than you might have expected.

The average interest rate on a checking account is 0.03%, meaning if you deposit $1,000, one year later you will have earned ... 30 cents. Meanwhile, the "prime rate"—a typical rate charged if you go the bank and take out a loan—is 5.5%. Using that same $1,000 that you deposited, the bank will earn $55 over that year from the poor soul who borrowed the money. That's over 180x more.

This would be like you buying a $120 set of headphones, and then turning around and selling them for $21,600. Not a bad deal for you, huh?

In truth, there's nothing wrong with making honest money. So why are we talking about this and what does it have to do with you?

If you're a beginner at personal finance—meaning that you haven't spent much serious time trying to figure out and manage your money life—then most general financial advice that you hear is USELESS.

It's not focused on you, it's five or ten or fifty steps ahead of where you're at now, and it's usually given to you by companies with serious ulterior motives. After all, they make their money on your money (think of the headphones).

Telling a financial beginner to go invest in stocks and mutual funds, when they don't even know how to plan and save the money to invest, is not helpful. It's like a snowboarding instructor showing you how to do frontside 180s and land killer jumps in lesson one on the first day, when you just want to know how to stand up on the damn board without falling on your face.

Totally counterproductive. This line of advice almost instantly turns off any beginner, who then says ugh, forget it, goes back to their regularly scheduled life, and puts their financial life back on “ignore”.

Advice and guidance should meet you where you are. And when you're a financial beginner, that's at the foundation, not at the tip top. As you've probably guessed, we're not going to talk about retirement. Or investing. Or budgeting strategies.

That might go against what you've heard, but remember that what you've heard is far from impartial.

The truth is that there are THREE THINGS—and only three things—that matter most when it comes to your money. Everything else is just details. And many of those details are flat out not important to beginners.

These three things matter to everyone. They matter to the destitute person trying to stay off the street, they matter to billionaires like Warren Buffett and Jeff Bezos, and they matter to you.

Interested?

Great, here they are:

Notice the simplicity? That's because deep down, personal finance isn't complex — there are very clear concepts and measurements which underpin everything, but are often overlooked in favor of fancy ideas and dreams of getting rich. But together, these concepts paint an accurate, complete, and clear picture of your financial situation.

That picture is your Financial Posture. It's a simple but powerful tool which covers your financial vitals, like a bedside hospital chart for your money life. It shows you everything you need to know at a glance, and gives you what you need to navigate any financial question or situation. Now we'll cover how.

Your Financial Posture

Your Financial Posture is an all-in-one snapshot of where you're at right now with your finances, where you're heading on your current path, and how quickly you're moving. It's hard to see the big picture when you're grinding it out through life, head down and eyes on the next paycheck. But it's necessary.

Getting bird's-eye-view of your money snaps you out of the trance and lets you think like you're in charge of your life, not just living inside of it. Instead of asking "when is my next paycheck?", you can start to ask "how do I get into a position that I'm not constantly worried about payday?".

Here's the blank framework for your Financial Posture. It starts off simple. And it stays that way.

Now we'll fill it in, one section at a time, starting with your financial position.

1: Your financial position

If you don't know this, it's like speeding down the freeway at 70 mph ... wearing a blindfold.

What's your financial position?

Your financial position is what you have today, right now. The fancy, official term for this is your net worth , which you can calculate by subtracting what you owe from what you own.

How are you doing with your money? Do you know for certain, or do you just have a vague notion? How would you truly know without measuring it? It matters because if you don't know, you can never make an informed and thoughtful decision. You're just guessing.

Can you actually afford to buy a newer car? Or are you just rationalizing because it's something you want? You're only human, so don't make it harder than it needs to be. Knowing your financial position opens your eyes, and shines a light on your situation so you can know, and not just guess.

Having a net worth of $200 can and should lead to a much different approach to life and money decisions than having $2,000.

To make decisions that are best for you, you need good information. Uncertainty and fear are paralyzing. They are roadblocks to actually doing something about your money problems. That spooky looking shape in the corner isn't a blood-sucking monster, waiting to pounce. It's probably just a stack of boxes. But that fear doesn't disappear you until you flip the light on.

Your position is also the yardstick that you will use to assess and understand your progress. You can guess, but you can never really know if you're successful unless you have something reliable and concrete to measure your progress against. If you go on a diet and lose 30 lbs., that's great. But did you start at 130 lbs., or 330 lbs.? There's a huge difference.

And know what?

Uncovering and understanding your position gives you this insight.

Having awareness of your position also gives you the chance to set a viable plan and make intelligent adjustments along the way. If you're starting out with a net worth of -$2,000 because you have so much credit card debt, it means that you should likely have different short-term goals and tactics than if you have $2,000 in the bank with no debt. Again, your priorities in these two situations can and should be completely different.

How to figure out your financial position

You can determine your financial position by combining everything you own (your “assets”), and then subtracting what you owe (all of your debts, or “liabilities”) to get your net worth. So as a very simple example, if all you had was $1,000 in the bank, and all you owed was $200 on your credit card, your net worth would be $1,000 - $200 = $800.

Examples of assets

Money in the bank

The value of your car

Money that people owe you

401(k)s and retirement accounts

Cash stashed in your sock drawer

Examples of liabilities

Credit card debt

How much you owe on your car loan

Student loans

Medical debt

Unpaid bills

Want to quickly and easily get your financial position? Try the Personal Finance Snapshot, for free.

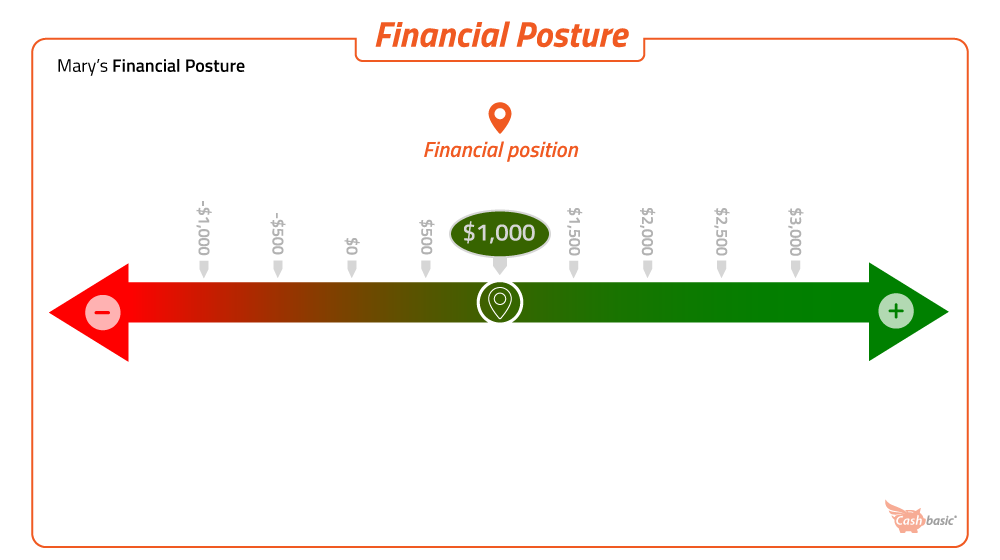

Let's take the make-believe example of Mary...

We'll build out her Financial Posture as we go along, starting with her financial position.

Mary's assets and liabilities (what she owns and owes)

Assets | Liabilities | ||

|---|---|---|---|

Name | Value/balance | Name | Value/balance |

2015 Toyota Camry | $7,500 | Loan on Camry | $3,500 |

Checking account | $800 | Visa credit card | $3,000 |

Savings account | $500 | Unpaid medical bill | $1,000 |

Cash | $200 | Personal loan | $500 |

Total assets | $9,000 | Total liabilities | $8,000 |

Net worth: $9,000 - $8,000 = $1,000

2: Your direction

Have you ever been truly lost? It's terrifying. Turns out, you can get lost financially too. Except with your money, you may not know it until it's too late.

In everyday life, it's pretty obvious whether you're going in the direction you want. You have constant visual feedback to compare and contrast. If that tree was ahead of you and now it's behind you, you can be pretty sure that you're driving forward and not backwards.

This isn't as easy when there aren't direct visual and physical cues for you. And that's especially true for spending money, since spending is now so streamlined and simple to do. You can swipe a card or enter a credit card number in a few seconds then move on, and forget all about it by the end of the day.

When you compound this week after week, isn't it easy to see how spending turns into a mystery and leaves you asking “what happens to my money” every single month?

If you aren't using cash exclusively or using a physical budget like the Envelope System, there are very few waypoints and landmarks to help you keep your bearings ... just a blur of decisions and actions. You probably feel like you're wandering around in a thick fog.

With money, you can be getting further and further into debt. The fog gets thicker. It starts to choke you. And you don't even know if you're escaping, or just wandering in deeper.

Direction tells you this. It tells you if you're progressing or regressing financially — if you're spending more than you're bringing in, or if you have money left over at the end of the month.

If you're spending more than you're bringing in, your financial position is eroding. You could have tens of thousands of dollars sitting in the bank, even hundreds of thousands, but if your direction is negative, you are losing money. And given enough time, you WILL go broke. It's a mathematical certainty.

On the other side, as long as you are spending less than you earn, you will always be progressing positively, saving, and improving. Even if you are flat broke now, as long as your direction is positive, you won't be broke for long.

This is why direction matters.

How to figure out your direction

Once you start paying attention, direction is the simplest of the three factors to work out.

If you are spending more than you're earning, and losing money over time, you are going in negative direction. If you are gaining money over time, you are going in a positive direction.

Is your bank account balance growing, or shrinking? Are your credit card and other debt balances growing, or shrinking? All of the money that you spend either comes from your assets, or it comes from someone else's. That someone else (think: credit card issuers or banks) is VERY GOOD at tracking what you owe them. They won't miss it. So it's relatively easy to tell what's happening with this one, once you decide to pay attention.

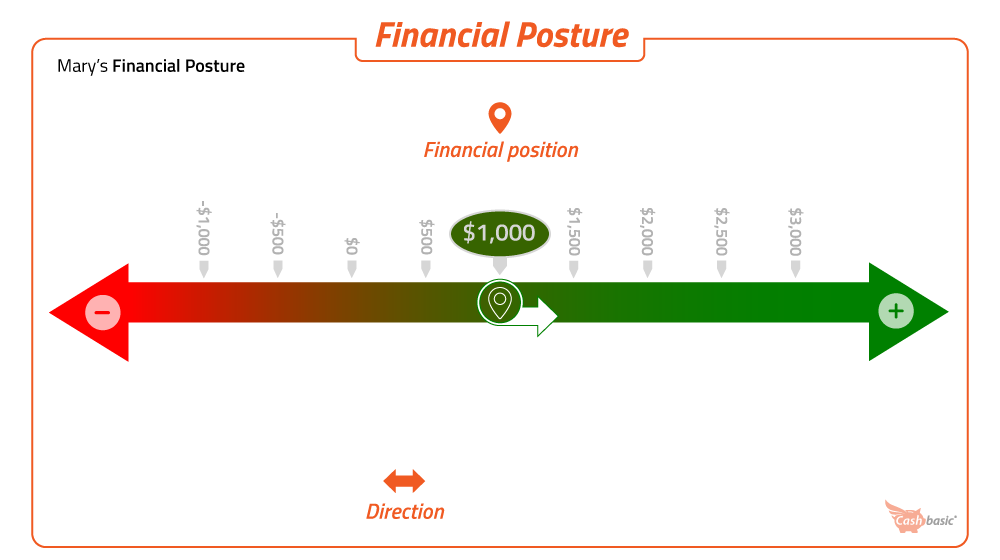

Getting Mary's direction

Mary takes a look at her bank account and credit card statements. Over the last two months, her bank account balance has increased a little, and her credit card balance has dropped by a couple hundred dollars. That's all that she needs to know to understand her direction. It's positive.

3: Your pace (how fast you're going)

Are you walking or running towards that pot of gold ...or that cliff?

Direction doesn't tell the whole story. It's simple to figure out and understand, but it isn't enough.

You need to know more.

What's that last puzzle piece? It's your “pace”, which is how much you're spending (in a negative direction) or saving (in a positive direction).

When you're driving to work for example, you need to know you're heading the right way. That tells you whether you'll get there at all or if you'll end up just driving into a lake. But it doesn't tell you when. If you're driving 100mph, you'll get there at a different time than if you going 10mph (and about to get road-raged).

When you combine your direction and the pace that you're travelling in that direction, it gives you your “net spending”, or your “cashflow”. These are just fancy words that mean what you have left over at the end of the month (or on the other end, how much your credit card balance has increased because of more debt).

If you're overspending by $10 every month, it's clearly a different Posture than if you're overspending by $500. You're losing money much slower, and even if you're going in the same direction in both cases, you can sustain your situation much longer, depending on your financial position.

How to figure out your pace

Your pace can be more complex and challenging to figure out, which leads most people to ignore it.

But the fog has to be blown away, or you'll never know what's happening until it's too late. To determine your pace, you subtract what you're spending from your total earnings (paychecks, side gigs, etc.).

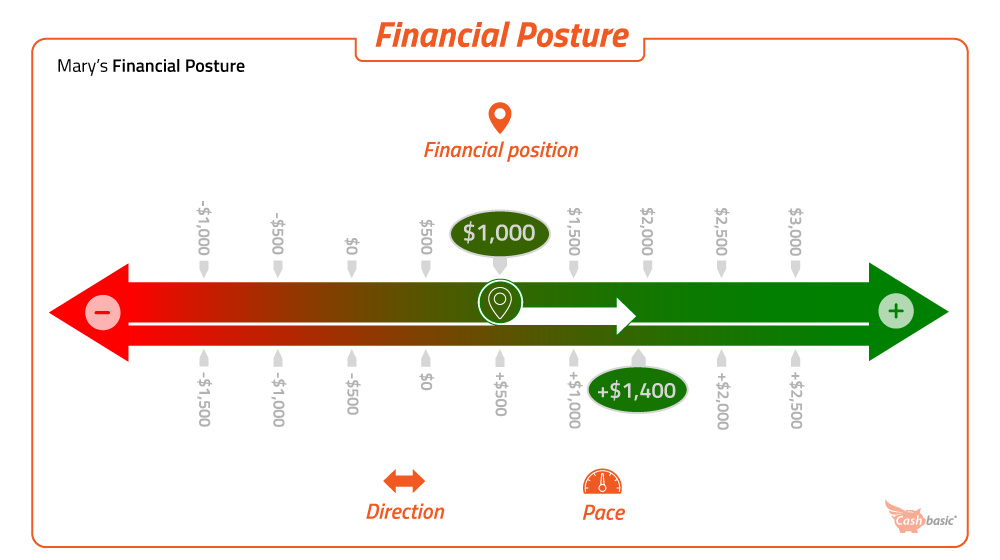

Getting Mary's pace

Mary is earning $1,700 each paycheck and gets paid every two weeks, so she is bringing in $3,400 per month.

Here are Mary's expenses:

Rent: $1,200

Car payment: $300

Insurance: $150

Groceries: $200

Gas: $150

Total: $2,000

Cash flow: $3,400 - $2,000 = +$1,400

This is Mary's completed Financial Posture.

Note that you can tell everything that you need to know with just a glance at Mary's Posture. You know how much she has, you know whether she's moving in a positive or negative direction with her finances, and you know how quickly that's happening.

For financial beginners (and most people actually) these are far and away the three most important things to know and understand about your money.

Let's work through a few more examples

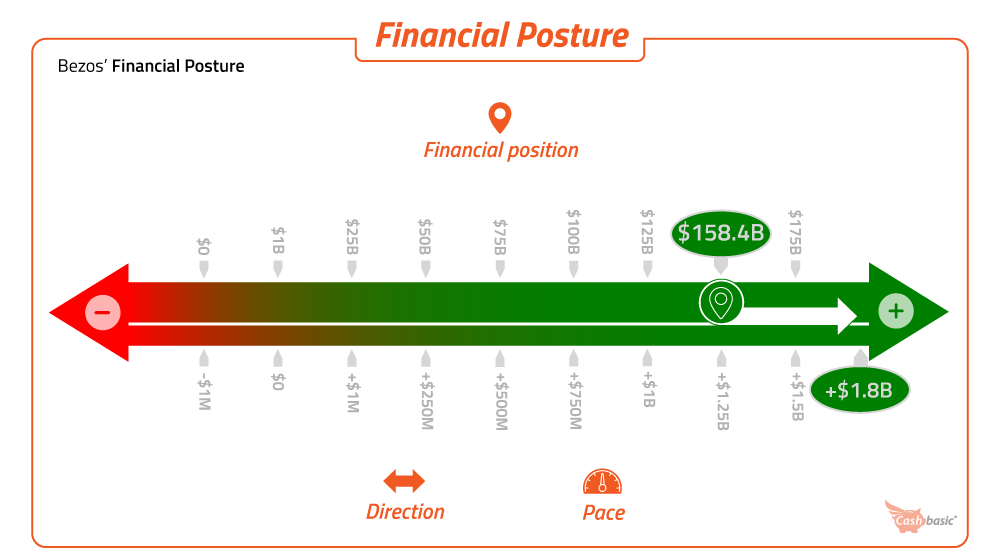

Each of the three parts of your Posture—your position, direction, and pace—are critical. And again, this applies to ANYONE. To prove it, here are a few examples. At the most extreme positive side, let's build a Posture for Jeff Bezos, the billionaire founder of Amazon (...and aspiring space explorer).

Bezos' Financial Posture

According to Forbes, Bezos has $158.4B, and brought in an additional $1.8B last year. But that doesn't make him invincible, because just like you, each part of his Posture matters. If Jeff's direction went negative and he spent too many millions on building and launching suspicious-looking rockets, he could go as broke as MC Hammer.

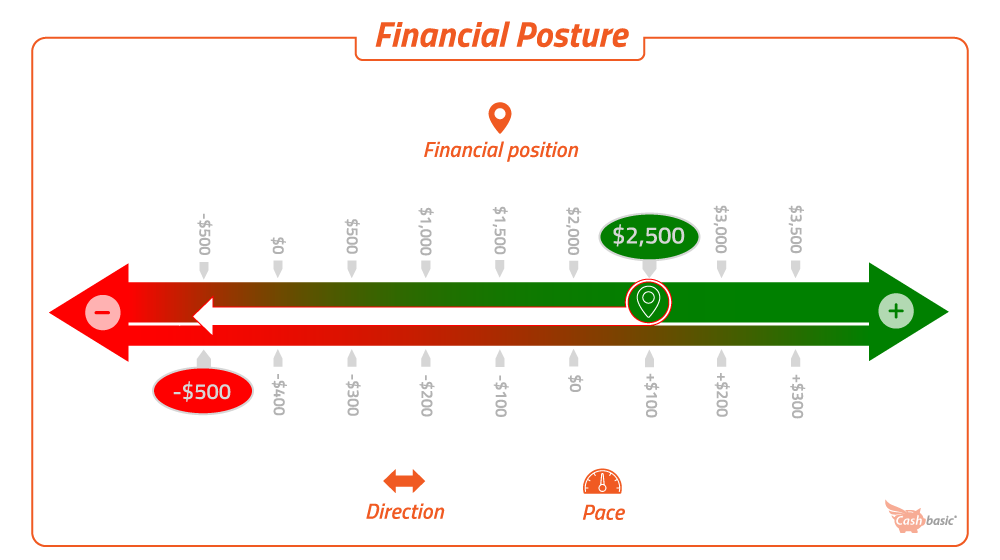

To shift to something a little more down to earth, here's an example of Posture for someone who has inherited a bunch of money and now has a great position, but doesn't have the financial discipline to control their spending.

Financial Posture: positive position, severe negative direction

If you only looked at how much they have in the bank, this one would look pretty solid. But how much you have is only one-third of the story. Here, the direction is negative and the pace is high. In fact, it's so high that if they don't figure out a way to fix their spending, you can tell with simple math that they will be flat broke in only 5 months.

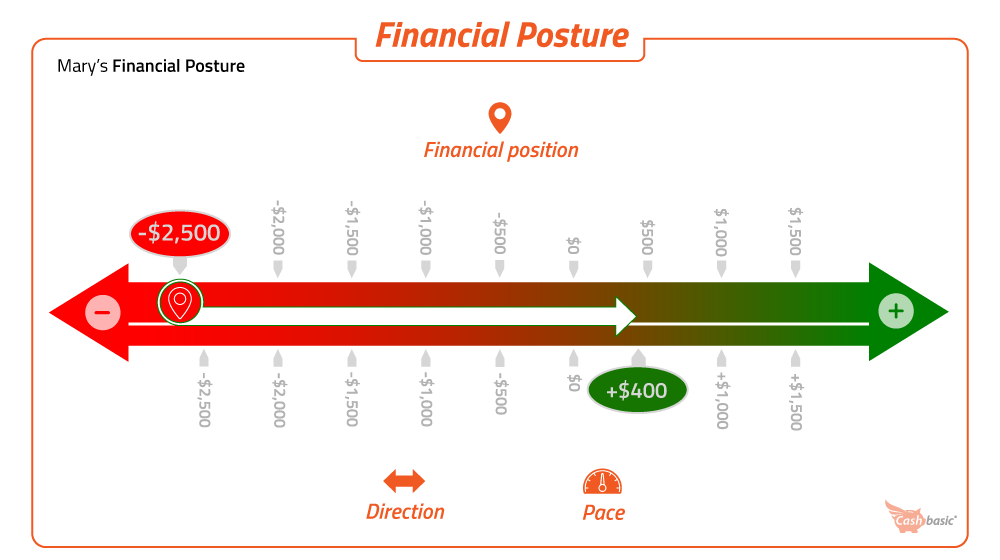

And on the opposite end of the spectrum, here's a scenario where someone is broke and in debt, but is also doing very well on the spending side, and rapidly making up ground.

Financial Posture: negative position, positive direction

At first glance, this person looks like they're in trouble (and they may be given their steeply negative net worth). But again, you can't get a complete picture without all three parts of the Posture. This person is doing very well on the spending side. In 25 weeks, or a little over 6 months, they will have earned enough to have paid off their debt and started moving their position to the positive.

Set your direction

Once you know what your Financial Posture is, the next natural question is, should you be concerned about your situation? And what should you do about it?

Luckily, you can use your Posture to predict exactly what will happen in the future with your money, and understand it at a glance.

If your financial position (net worth) is $2,000, you might feel secure at the moment. But if your direction is negative, and your pace is $500 per month and stays there, it's a mathematical certainty that you'll be flat broke in four months.

As long as your direction is positive, you have a generally stable Posture. But you can still get into trouble if you have an emergency that really hits your financial position directly. That could be an unexpected medical bill, serious car trouble, or losing your job.

To have stability and safety, you want a secure position and a positive direction. If you are looking to really start bettering your financial position, a strong pace will also be necessary.

Tips for improving your Financial Posture

Get your direction positive. You should be RUTHLESS about this. Become a merciless slayer of unnecessary spending. Because if you have a negative direction, you're gradually being bled dry, and it's only a matter of time before you're broke. Get this fixed as soon as possible, so you at least have time to maneuver and improve.

Get your financial position to a point where it will cover most conceivable emergencies, like car trouble, medical bills, or a temporary loss of your job. This ensures that you won't need to use expensive credit card debt (and pay 20%+ in interest until it's paid off) if something unexpected happens. Check out Cashbasic's free do-it-all guide on this if you're interested in learning more on how to build an emergency fund.

How much should your emergency fund have in it? Check out this free calculator to find out in a few seconds.

Increase the pace of your positive direction. You do this by thoughtfully cutting your spending or increasing how much money you're bringing in. This will gradually increase your financial position and put you in a safer place over time. Check out this post for some ideas on how to save money, or this one on some simple money-making ideas.

Start to set goals. Once your direction is positive and you're feeling safer and secure, then it's time to start thinking more about some the more common financial advice. That could be saving up for a newer, more reliable car. Or saving up for a down payment on a house. Or saving for a wedding. These are important, but they HAVE to come after your Posture is stable. Not before.

Now what?

It all adds up to this.

If you're a financial beginner, the most important things when it comes to your money aren't best practices like budgeting, or specific goals like retirement or saving. The #1 thing is thoroughly understanding what's happening with your money—knowing where you're at, and where you're going.

This is radically simple. But would you believe that there's a psychological step even before these? There is. That's getting started, committing, and beginning to take those first baby steps in the right direction.

As simple as it sounds, that's the truth. Many people ignore their finances because they're afraid, or the situation seems too complex or like it'll take way too much time to get right. But taking those first steps starts to open doors for you, makes you think in constructive new ways, and shines disinfecting light on your situation. Who know's what it'll show?

That's why taking that first step is so critical.

Ready to take it?

Video coming soon...

Share this post

There are no comments yet.

Pete Zimmerman

I've worked in financial services for more than a decade, and know where all the bodies are buried (and where the motivations are). I'm a Certified Financial Planner® and a licensed real estate broker, and love using what I've learned to simplify financial concepts and bring them to life in the real world, for working-class people like you.

Interested in more money ideas and solutions for your life?

Join Cashbasic's mailing list today and get exclusive content and offers direct to your inbox.

Social Connections

Special Thanks

Get Cashbasic's very best content (and exclusive offers) direct to your inbox.

No spam, ever. And we never share or sell your information.