Why is budgeting important?

Pete Zimmerman | 10/15/2022

This post at a glance

( TL ; DR )

If you're in a hurry, you can also hit GO TO VIDEO below

Read time: 10 minutes

Summary: Budgeting seems complex and intimidating at first, but it’s nothing more than a personalized plan for directing where your money goes, and where it doesn’t. It can be a little work to set up at first, but the payoff is well worth it, lasts for years (or a lifetime!) and can even lead to other positive changes. Why is budgeting important? Mostly because you owe it to yourself. But also because it helps you take control and maximizes your chances of getting what you want, when you want it.

Why is budgeting important?

The word “budget” sucks. It’s vague (is it something you do… or something you have?), it can mean completely different things depending on the situation (are we talking about something stuck to the clipboard of some corporate bean counter?), and the confusion around it leads to anxiety, indifference, and paralysis. Meaning, who cares?

Just for fun, try to do a quick internet search for "budget" and see what you uncover. Hmm...a car rental company. And a...truck rental company. Even the first REAL definition on Google is crap because it relates to a company's budget. That's not helpful.

Considering you can’t even find out what it is in a typical internet search, you can be forgiven for never even giving the concept the time of day.

So let’s talk about that first.

What is a budget?

Budgeting seems complicated, but in reality, it’s really nothing more than a plan for how to spend (or not spend) your money.

You can layer complexity on it by zeroing your spending against what you’re earning, or by dividing the spending into different categories, assigning priority, and then deciding how much you want to spend on each. But going even that far isn’t necessary to count as a “budget”. And it isn’t even appropriate for a lot of situations.

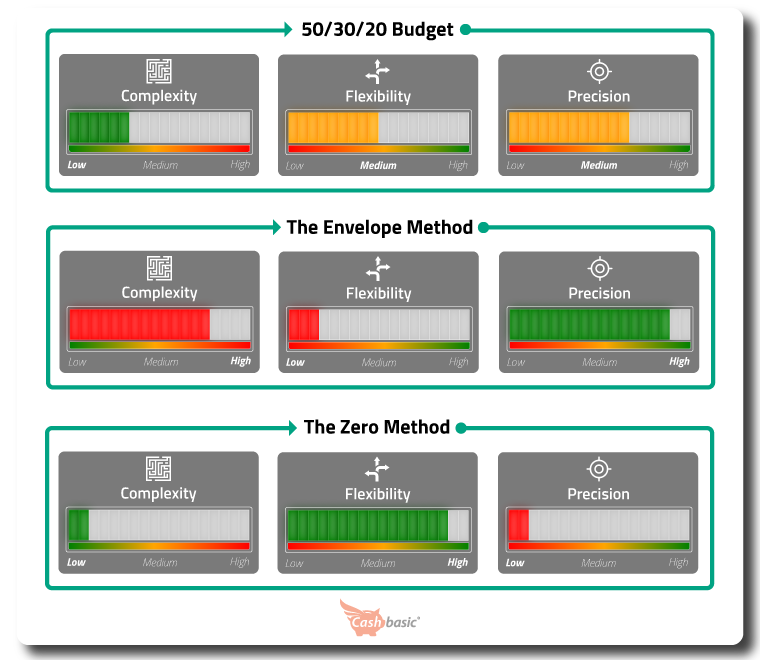

There is actually a huge number of different ways to budget. This isn’t the article to go into each of them in detail, but showing a few will help show you that it isn't hopelessly complicated, and isn’t worthy of your worry.

The 50/30/20: you spend 50% of your income on needs, 30% on wants, and the remaining 20% on either debt repayment or savings. Check out this simple calculator for a personalized, real-world example of the 50/30/20 approach.

The Envelope Method: this is an example of a style that’s more involved. You use an envelope (real or electronic) for each “category” of your spending. At the beginning of each month, you put money in each envelope to cover your spending on that category. Once the money is gone, you can’t spend any more there until it gets refilled at the start of next month. For example, you may have a “shopping” envelope with $150 assigned to it. If June is half over, and you’ve already spent $120, all you have to do is look in your envelope to immediately know that you only get $30 more until the beginning of July.

The Zero Method: each dollar that comes in from your paychecks is assigned a job, with a goal of having a remainder of 0 at the end of each month (hence the name). The idea is that anything that you don’t spend goes into a savings account, meaning that you’ve saved and still zeroed out the month.

There are dozens of other options out there, but the important takeaway here is to understand what a budget is, and what a budget isn’t. A budget is anything that helps you to systematically control your spending. What isn’t a budget... is spending your money blindly, with no real goal or plan, and just being lucky if you haven’t spent more than you earned at the end of each month.

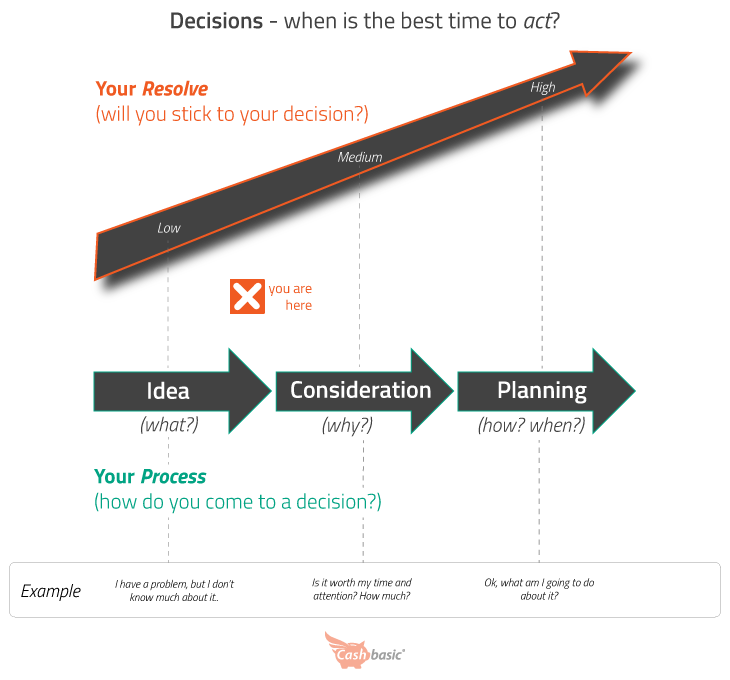

So now you know the word “budget”, but we aren’t going to talk any more about actually creating a budget. After all, the title and focus of this piece is “why is budgeting important?”. And the process of creating a budget is about five steps ahead (steps that you don’t want to skip).

If you just started thinking about getting a new car, would you walk into a car dealership, make a bee-line for the manager’s office and ask for a pen to immediately start signing papers for the first car you saw when you pulled in? You’d be every car salesman’s waking dream… but no, that’s not how it works. Before you even get to the shopping part, let alone the negotiation part, you probably need to think it through, to make sure you’re even making the right decision.

Do you even need a new car? If so, why? There are so many mental steps in between. You have to develop the resolve to make sure it’s right before you make it happen. If you don’t have that solid decision and understand the “why”, you’ll waver. It’s the same mental process with a budget- you need to know why you’re doing what you’re doing before you can develop the mental firepower to follow through and make it happen. When it gets difficult, you have a solid foundation- you can always fall back on your “why”. For example, “I’m not spending on this new coat because it’s not as important to me as stashing another $100 in my new car fund”. But if there’s no good answer when you ask yourself “why am I doing this anyway”—and that question WILL come up—then your resolve will evaporate as easily as it started.

Let’s be real. Unless you’re a weirdo, budgeting isn’t going to be your idea of fun- it’s not easy, and it can seem unfamiliar and foreign if you’ve never done it before. Not a good start. Why should you do anything that’s difficult or unfamiliar, let alone NOT FUN on top of it? For the same reason that you brush your teeth twice every day. Or eat healthy food. Or get up in the morning and go to work on a cold, rainy day when you’d prefer to just stay in your warm bed. Because at some level, you’re doing it for a payoff. Know what? Easy has a cost, too. The payoff for brushing your teeth is no cavities and better breath. Eating better food helps you stay healthy. So what is the payoff for budgeting?

Saving money? No, absolutely not.

Think about it: money is just small pieces of green-tinted paper (or digital records at your bank). It doesn’t have any real value outside of what it can do for you. So here's the real answer: Budgeting helps you do more of what you want with your money, and less of what you don’t. It doesn’t help you “save money”, because even saved money is eventually spent (just on something else). A budget helps you put a personal framework around how you want to spend money. To drive the point home, don’t even think of it in terms of money, think of it as competing uses for your money- different things that you can do. Money is just the way it all gets measured—a way to keep score and save us from having to barter—it's nothing more.

Let’s take the make-believe example of Shelly...

Shelly is a photographer, and she makes $20 an hour (or about $40,000 a year). She wants to buy a home of her own, but it’s been tough for her to make ends meet each month and she HATES tracking her money. Her house down payment fund has some money in it, but it usually sits neglected because she feels like she never has any money to add to it.

One day, she has an epiphany. Her house fund hasn’t grown for over a year, but she has a lot of “stuff” that she didn’t have a year ago. Does she really KNOW that she doesn’t have money to add to the fund, or is it more that she DOESN’T KNOW at all? The result might be the same, but those are very different things in terms of control. She wonders out loud if she’s been deceiving herself because of fear, laziness, or just indifference. But these are HER goals, no one else’s, and she owes it to herself to know.

Shelly tracks everything she spends for a month, and her suspicions are confirmed. She is only spending about $1,700 per month on things that are required (like her rent, car payment, cell phone bill, etc.). The rest has gone to impulse buying and mindless spending. Turns out, she has had plenty of chances to put money towards her house fund, but chose not to. Now it’s a year later and it hasn’t budged. And the worst part, it could have grown by about $400 per month – that’s $4,800 over a year’s time! What a waste, and not just of money (more on that shortly).

This might be a made-up example, but if it sounds at all familiar, that’s because it’s REALITY for millions of people. The majority of people don’t work off a budget. Before you take any comfort in that, also realize that the majority of people also don’t have two nickels to rub together for an emergency. That brings us to Reason number one for having a budget.

Reason 1: Why is budgeting important? Because you owe it to yourself.

Once you leave the safety of childhood and adolescence, and step wide-eyed into the real world, you realize in a hurry that life isn’t easy, and the world isn’t going to serve up riches and fame to you simply because you’re here. Live involves work, and if you want to be successful (or even to subsist), you need to chart your path in life. Set goals, and make them happen. Terrifying, but liberating.

So you have goals for your life, but others have goals for you too. And outside of your friends and family, those competing goals generally consist of persuading you to expend your money and energy to help them. That’s not cynical, and it’s not good, or bad. It’s just the way it is. You’re drowning in a sea of advertising and marketing, and temptations, and there are opportunities everywhere to go off track. It’s actually far EASIER to just say yes when something REAL is in front of you. Overdraft notices and negative account balances are reminder enough of that.

But your goals for yourself are more important than what others want. Those goals could be anything, and they can change and adapt as often as you need them to. The important thing is that they are YOURS, and you aren’t just being tossed this way and that, and blindly acting on the heat of the moment.

You owe it to yourself, and all of your past struggles to stay true. Did you just finish a 45-hour workweek, dealing with rude customers, cheap tippers, and aching feet? And if, instead of using that money to progress towards what you WANT – what you were working for – you were persuaded by coworkers to spend two days’ worth of hard earned money on a few hours of drinks, you aren’t being true to yourself.

But you can’t know if your being true unless you pay attention. The only way to pay attention to spending is with a budget (of some kind). Remember a budget doesn’t have to be complicated. It just has to work, and to ensure that you’re doing what you know you should be doing with your money.

Reason 2: A budget will prevent you from going broke

Done correctly, a budget WILL prevent you from going broke at the end of each month – it’s a 100% certainty. Seem far fetched? It isn’t, because when it comes down to brass tacks, it’s just math. If you make $10, and spend less than $10, you’re in the clear. The key is understanding how much you’re bringing in, and then forming a plan around your spending so that the monthly total doesn’t exceed your earnings. As long as it doesn’t, you’ll – at minimum – break even each and every month. No more overdrafts, and no more steadily-increasing credit card bills.

Disclaimer: The ONLY time this won’t hold true is if you are spending more on ESSENTIALS than you’re making. This is a dangerous situation, and means that what you earn in your paychecks isn’t even enough to cover your rent, car payment, cell phone, food, etc. It’s not common, and when you really dig in, you might learn that “essential” isn’t necessarily essential- there’s a chance that you could still even things up by cutting back expenses. And if you’re truly in the red at month-end, it means that you’ll need to fix it in some way, whether that means getting a cheaper phone data plan, eating out less, or finding a roommate.

Reason 3: Not budgeting doesn’t just cost you money, it costs you TIME

You often hear that “money can’t buy time”. Not true- you probably buy time…all the time. Each evening that you order Doordash instead of driving to Panera for a salad, you’re buying time. Ever paid someone to do something so you didn’t have to? Same thing. So time’s a commodity (even if it’s limited) just like money, and it can be bought.

But what you can never, EVER buy is lost financial potential. And financial potential is often disguised as time. Did you know that it takes about 10,000 hours of practice to master a skill? At an hour a day, that’s 27 years of practice to get there. If you wanted to become a virtuoso at piano, could you just pay someone to learn for you? Nope, you have to put in the work. If you wanted to start five years ago but didn’t, guess what? That potential is lost, and if you start today, it’ll be 32 years from now. Whether that 10,000 number is correct is open to interpretation, but no one can argue the point that time is the price you pay for personal progress.

It's the same with earning money. Earning wages takes TIME. If you make $14 an hour, that new $100 coat cost you almost 8 hours – nearly an entire day of your working life. Worth it? Maybe. That depends what your goals are. But understand that your earning potential is limited by time.

As a fun (and free) exercise, learn what you’ll earn TOTAL over your lifetime

So if you have goals for yourself, the sooner you start, the sooner you succeed. You can’t turn back the clock. If you want to save $15,000 for a down payment on a house, and you can save $150 per month, it will take ten years. If, for the next two years, that $150 is instead spent on frivolous things that you didn’t need (or even want!) to begin with, it’s going to be 12 years before you get there. This is a big deal. Know what your goals and priorities are, and know that it’s YOUR time. If some marketer or stealth social media influencer-advertiser wants you to spend your hard-earned money on something else you didn’t even know existed ten minutes ago, think of it in terms of losing your time, not just your money.

Reason 4: Budgeting is how you take control of your spending (and your life)

In 1972, researchers at Stanford University in California started an experiment that later became known as the "marshmallow test" . It's now something of a legend among psychologists and others that study human behavior. In the experiment, preschool-age children were sat in a room and presented with two options. They could have a single treat now (a marshmallow or pretzel), or they could wait for an unknown amount of time, and get two treats. To make the decision real for them—or maybe just to be jerks—the researchers put the treat in front of the kids. As you’d expect, this was a challenge for them. As you might not expect, it also had amazing long-term predictive power on the future lives of those children. What could a marshmallow tell you about the future? As it turns out, a lot.

Studies and follow ups on the experiment participants over the following 40 years showed that the children who were able to resist and hold out for more (i.e. delay gratification) had much more measurable success in many areas of their lives. From better responses to stress and lower levels of substance abuse, to lower levels of obesity, the ability or desire to exercise self-control proved to be critical for success in life.

When it comes to money decisions, those temptations aren’t just kids' treats, and aren't one-and-done - they’re actually an endless parade of distractions and desires. And the payoff for restraint and prudence isn’t just 15 minutes away, it could be many years. You deal with an adult version of the marshmallow dilemma, and that self-control gets infinitely more difficult as an adult because you are ALWAYS being tempted. We live in a society that is driven by advertising. Every social media platform or internet search is hijacked by ads, constantly hammering you with “buy this, buy that”, while your goals (meaning what you really want) live stubbornly in the future, out of sight, distant, and blurred by uncertainty.

If you have a goal to buy a new car, the tempting marshmallow sitting in front of you is the shiny new cell phone that you saw advertised on Instagram, and a parade of other appealing things that beckon to you and whisper sweet nothings in your ear about how “life is short” and that new car doesn’t like you anyway. It’s just a few dollars, after all.

So how do you silence this incessant racket of spending distractions and stick to your guns? If you guessed “a budget”, you get a prize. Want to spend on $100 on a new coat, but not sure if you can afford it and still be on target for your goals? Your budget will tell you that. When you find and adopt a system that puts guardrails around where your money goes and where it doesn’t, and consciously and thoughtfully organize your spending, you are now acting as an agent of your own interests, like an advocate for yourself. Think of yourself as your own guardian angel, looking at your life from afar and making sure your decisions align with what you REALLY want.

There are a lot of things in life that you just can’t control. But you can control yourself and your decisions when it comes to your money. If self-control leads to success in life, then spending control can lead to success financially. And this mindset also puts you the path to success in life generally as well, since it leads to a mentality of responsibility and thoughtfulness in a broader sense.

Reason 5: Budgeting helps you get what you want

Money can’t buy you everything. It can’t buy love, or true happiness, or financial potential (like we mentioned earlier). But it can buy most things, and despite what people like to say, that’s not superficial. Money gets a bad rap, but it’s really just a tool, and it’s intimately involved and intertwined in how we live and grow as people. Think about it- want to buy a newer car so you won’t have to worry every damn day about whether or not yours will break on the way to work? That’s not shallow or insincere, it’s life. And money accomplishes it. It’s the ONLY thing that accomplishes it.

So money helps you get what you want. And more money means getting more of what you want. But how do you take advantage when you—like everyone—have limited money coming in? There’s only so much to go around. Here’s how: you get laser focused on what you want and cut out what you don’t, deliberately and systematically. You get more of what you want by NOT spending on things you don’t, and redirecting that money to your priorities. For example, if you like traveling more than anything, spend more on traveling by spending less on shopping and less on mindless purchases. Budgeting is all about prioritizing, and prioritizing gets you more of what you want.

Reason 6: Budgeting forces you to prioritize your life and be more deliberate about it

Life’s full of possibilities. And distractions. Anyone who has ever binge-watched a series on Netflix, or spent hours mindlessly surfing the internet or scrolling on social media—instead of doing their laundry or mowing the lawn—knows that there is an infinite supply of people, companies, and priorities vying for your time and attention, pulling you in different directions. It’s no different with your finances. If I asked you to compile a list of things that you’d like to do or to buy, you could put together a pretty good group. And most of those things would cost money. Since money isn’t limitless, you need to prioritize, and you do that by determining what holds the most value for you personally and demoting the rest to the bottom of the list. Money goes first to the priorities, then the next goals, and so on, all the way to the less-important items. Visualize it like a stepped waterfall.

Life is full of decisions. In fact, how many decisions would you guess that you make each day? Think small…not just big decisions. Did you decide to hit the snooze button once or twice before getting out of bed? Did you choose to wear a long-sleeve shirt or a tee to work? Which arm did you put in first when you put it on? You can see that this can get very detailed.

Did you just make a decision to keep reading?

Good, you’re almost done.

It’s notoriously hard for researchers to estimate, but some reputable sources say adults make 35,000 remotely conscious decisions every day. That adds up to about 36 decisions every minute you’re awake. In practice, you couldn’t live your life without prioritizing those decisions and having a subconscious system to organize them (more on that in a minute). And in the midst of all these choices, you have to make decisions about your money too.

For example, if you want to eat healthy and have the time and ability to prepare your own food, the cost isn’t huge. But if you also want time-savings and convenience along with it, the cost can skyrocket. A meal from EatFitGo will cost multiples more than McDonald’s. So what do you prioritize? It depends on your goals and your values. The purpose of a budget is to align your spending with those goals and values. Remember, it’s not “what you can afford”. It’s what you can afford while still staying true to your OWN goals.

The truth is that you have limited resources and time, and a lot of different options. The way that people deal with options is to prioritize, and the way that you prioritize money and spending is with a budget. Budgets make your decision-making easier and more streamlined because you have a system to handle it. Think about it like a smoothly-running conveyor belt in an assembly line, versus randomly throwing pieces together with no plan.

BONUS Reason 7: Budgeting helps you build better habits

There’s a phenomenon called the Diderot Effect. It’s this tendency for spending to cascade, and purchases to build on one another in an avalanche of frivolous spending. Before you know it, you’ve spent money you’d set aside on a bunch of stuff that you didn’t need. Spending becomes a habit.

As a bonus, budgeting also helps you build better habits. Each prudent money decision you make, and priority you honor (and stay true to yourself) is like adding a small vote for the person you want to be. It starts off as a slog. Each time you do it is a pain. But it gets easier and more automatic. Eventually you aren’t just watching your spending. You are a person who watches their spending.

This is a huge difference. It changes from something you do (consciously and with effort) into the way you behave and who you are – your identity. This happens primarily by creating good habits. Your good behavior just becomes part of you. And success is built on small, step-by-step positive changes, not by some miracle overnight transformation. It’s on autopilot

The best way to set up this positive cycle is to start very small, and gradually build on your successes. For example, start by saying that you won’t spend more than $20 each day on things that aren’t necessities. Once that is done, and is happening automatically (but not before), then take the next small step. And the next.

Eventually, you’ve built a solid foundation of financial habits and you don’t even need to think about not spending and sticking to your guns. It starts to just happen automatically.

Why wouldn’t you want to budget?

Now you know why budgeting is important. So why wouldn’t you want to do it? Honestly, because it’s unfamiliar and does take some time and effort to set up. But on the plus side, this higher up-front cost results in an easier life long-term. You can put in the time now, or wait until the state of your finances force you to take action later in life. Would you rather take control and direct your own path, or give up control and end up wherever your whims (and the whims of others) lead you years from now?

Realistically, what are your options, and what are the expected outcomes from those options? That’s for you to answer, but at least you now know why it’s important to think those through and make a measured and thoughtful decision about your future.

Video coming soon...

Share this post

There are no comments yet.

Pete Zimmerman

I've worked in financial services for more than a decade, and know where all the bodies are buried (and where the motivations are). I'm a Certified Financial Planner® and a licensed real estate broker, and love using what I've learned to simplify financial concepts and bring them to life in the real world, for working-class people like you.

Interested in more money ideas and solutions for your life?

Join Cashbasic's mailing list today and get exclusive content and offers direct to your inbox.

Social Connections

Special Thanks

Get Cashbasic's very best content (and exclusive offers) direct to your inbox.

No spam, ever. And we never share or sell your information.